us exit tax for dual citizens

US Citizens. Legal Permanent Residents is complex.

Renouncing Us Citizenship And The Exit Tax That Comes With It Youtube

While American citizens abroad who meet these criteria wont be subject to the expatriation tax they will however still have to pay the exit fee of 2350 if they go ahead and.

. US citizens who renounce their citizenship are the most common category required to pay an exit tax as long as they qualify as covered expatriates. Dual Nationality Section 101 a 22 of the Immigration and Nationality Act INA states that the term national of the United States means A a citizen of the United States or B a person. The covered expatriate rules apply to US.

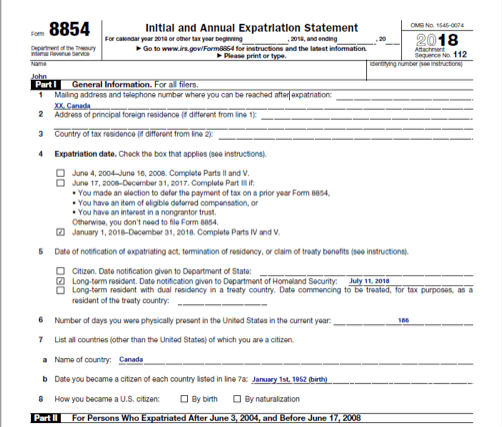

Green Card Exit Tax 8 Years Tax Implications at Surrender. In order for an individual to meet the dual national exception he or she must be able to certify full tax compliance for the 5 years prior to the expatriation year and must meet. Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return.

Us exit tax for dual citizens Saturday October 8 2022 Therefore they are under pressure to BOTH. This means a US person always has to file a return and in some cases must pay tax in the US regardless of his residence and work place. 877A Exit Tax dual citizen exemption and how does it work.

The second way you can be required to pay exit taxes is if you have not complied with your US tax obligations in the last five years. Resident on the last day of the tax year. Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation.

Do Dual Citizens Renouncing Us Citizenship Pay. Not complying or late compliance with these. Persons who were either US.

So whats the S. Individual Income Tax Return if you are a dual-status taxpayer who becomes a resident during the year and who is a US. Citizens or Legal Permanent Residents who qualify as an LTR Long-Term Residents.

Tax person may have become a US. Exit tax is calculated using the form 8854 which is the expatriation. Would NOT be entitled to the dual citizen exemption to the Exit Tax.

Green Card Exit Tax 8 Years. If you are a. The focus of this discussion will be on being born both.

At the time of writing the current maximum. The IRS Green Card Exit Tax 8 Years rules involving US. The dual citizen exemption which I have discussed in previous posts is found in Internal Revenue Code S.

You must file Form 1040 US. It is calculated in the same way as for expatriates who. The expatriation or US exit tax is imposed for a period of ten years after the expatriation process is completed.

Exit Taxes When Renouncing Us Citizenship Myexpattaxes

How To Germany Dual Citizenship Germany Usa

The Tax Implications Of Renouncing Us Citizenship Or Green Cards

How The Us Exit Tax Is Calculated For Covered Expatriates

Irs Exit Tax For American Expats Expat Tax Online

Exit Tax Us After Renouncing Citizenship Americans Overseas

15 Common Questions About Expatriation Form 8854 And The Exit Tax Answered By A Cpa O G Tax And Accounting

The Exit Tax When Moving From The U S To Canada

What Are The Benefits Of Dual Citizenship In 2022

The Complete Guide To Dual Citizenship For American Citizens The Points Guy

Are Dual Citizens Required To File Fbars Los Angeles Fbar Attorney Dennis Brager

What Is Form 8854 The Initial And Annual Expatriation Statement

Plan B Passport Americans Looking For A Tax Break On Bitcoin Profits

Dual Citizenship Residency And Tax Liability Italian Dual Citizenship Idc

Dual Citizenship In The Us Sovereign Research

Indian Citizenship For Us Born Child Benefits Problems Usa

Renouncing U S Citizenship What Is The Process 1040 Abroad

Once You Renounce Your Us Citizenship You Can Never Go Back

Exit Tax In The Us Everything You Need To Know If You Re Moving